The takeaway: To evaluate a long-term care policy, know the market price for care, know how to tell if the policy will be reimburse your current and future expenses, and know how well it will keep up with inflation. Here’s how you tell.

$$$

DepositPhotos.com – with permission

Whatever you do, don’t be the younger me. A while back, my husband and I were pitched a long-term care policy that, in today’s dollars, required a one-time payment of $169,000. In return, the policy would pay a total of $58,000 a year for any long-term care services either of us needed. Either one of us could use the policy as long as the total cost of our combined care never exceeded $58,000 annually.

There were two major problems with this policy.

The first problem was the price. Factors affecting the price of a policy–which can reach six figures–were explained in scintillating, sparkling, and scandalous detail here. (Boomer, please! Contain your excitement.)

The second problem was I didn’t know how to evaluate the policy, which means I didn’t know how to evaluate the policy’s “coverage.” Coverage is how much your policy reimburses you for the cost of long-term care services you might receive. In our state, the policy’s annual $58,000 in coverage barely covered the half the price of nursing home care for only one of us.

Don’t be the younger me, who had no idea how to evaluate a long-term care policy. “

Had my husband and I both needed nursing home care, the policy coverage was so minimal that our out-of-pocket costs would have been roughly $100,000 annually. And that’s after the insurance paid its share.

Boomer, let that sink in. 😯

Still, my younger self spent weeks mulling over the policy before finally rejecting it. It was only the agent’s annoying sales tactics that made me finally reject the policy.

Don’t be the younger me, who had no idea how to evaluate a policy. Know how to assess how well your insurance will reimburse the cost of your care. Why should you pay six figures for a policy and then pay another six figures annually for care in the nursing home?

To evaluate how good your policy is you need to know three things.

Wow! This chapter on coverage is a total page turner!!

In order to know how good your policy is, which for our purposes is how well you’ll be reimbursed for the costs of any care you receive, (i.e., “coverage”), you need to know:

- the market price for long-term care services;

- how to tell if the policy will reimburse your current and future long-term care expenses; and

- how to tell how well the policy will keep up with inflation.

Here’s how to tell.

#1. Know the market price for long-term care services.

For the policy I was pitched, I should have known the market price for long-term care services. Since I didn’t know the market price of long-term care, I couldn’t evaluate coverage. At that time, I didn’t realize that coverage for two of $58,000 was peanuts relative to how much long-term care costs.

Once you know market prices, you know how much coverage you need–at a minimum.”

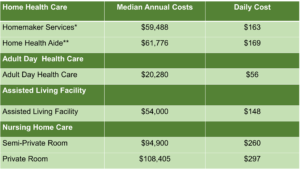

Table 1 below shows national figures for the annual cost of long-term care services. Click here for the cost of care in your state.

Table 1. The 2022 Median National Market Price for Long-Term Care Services

Notes: *Based on five days a week for 52 weeks; **Based on 44 hours a week for 52 weeks. Daily costs may not include federal, state, and personal holidays. Source: Genworth Cost of Care Survey: Median Cost Data Tables, 2022, Genworth Financial, Inc.

Once you know the above market prices, you know how much insurance you need–at a minimum.

Coverage is how much the policy reimburses you for the cost of long-term care you might receive. “

#2. Know how to tell if the policy will reimburse your current and future long-term care expenses.

Table 2, below, shows a policy illustration whose long-term care coverage amply exceeds today’s current cost of yearly long-term care. How do we know this? We know because we saw earlier in Table 1, above, that the national cost of nursing home–the most expensive form of long-term care–was $108,405 a year.

In contrast, Table 2, below, shows an illustration of a policy that covers $165,000 in long-term care costs–or 52% more than today’s national market price of nursing home care. With a policy like this, your nursing home costs would typically be covered. Why? Because you can see that the gap between the market price of care (Table 1 above) vs. what the policy will pay (Table 2 below) is substantial (i.e., 52%). The policy in Table 2 covers the market price of care and then some.

Table 2. Composite Policy That Has Inflation Protection and Exceeds the National Market Price of Care–Both of Which Portend a Decent Chance of Covering Services You May Require.

Note: The long-term care price index is based on an annual market survey conducted by American Association of Long-Term Care Insurance. It assesses how much policies are selling for, what their coverage is, and then through the Association’s own proprietary procedures projects the optimal price and coverage that suits the needs for most prospective insurance buyers.

Source: The 2022 Long-Term Care Price Index, developed by the American Association of Long-Term Care Insurance (www.aaltci.org).

The table above is for a traditional long-term care policy. A traditional long-term care policy is a “stand alone policy” not linked, for example, to a life insurance or annuity policy, which are two other ways to buy long-term care.

Awesome news, everybody! I got the benchmark for long-term care coverage!!

Regardless of what kind of long-term care policy you buy, you can use Table 2 above as as a benchmark for the level of coverage to shoot for. When you find this level of coverage, decide for yourself if the price meets your budget–then shop around. Companies vary markedly in the price they charge for the same coverage.

Sidebar if you please. Table 2 is a composite policy–an illustration if you will. It’s only purpose is to give you an idea of the kind of coverage you might want to look for. No endorsement is implied and know that your mileage will vary depending on your age, gender, and assorted other factors.

Companies vary markedly in the price they charge for the same coverage.”

#3. Know how well the policy will keep up with inflation.

Long-term care costs are increasing at a rapid clip. Table 3, below, shows how fast these costs are increasing each year. Click here for the average annual price increases for your state.

Table 3. 2022 National Average Price Increases for Long-Term Care Services.

Source: Genworth Cost of Care Survey: Median Cost Data Tables, 2022, Genworth Financial, Inc.

Yes or no! Does the policy exceed the current cost of care, and if it does, does it include inflation protection?

To keep up with the increasing cost of care, you’ll likely not only want a policy that already exceeds the market price of long-term care, as discussed earlier, but one that also offers inflation protection. Inflation protection is the percentage by which the insurer increases your coverage each and every year. Companies typically provide inflation protection that increases your coverage anywhere from 1% – 5% annually–with 3% being the most popular.

The higher your inflation protection, the more expensive will be your policy.

If you find the cost of your policy increases to more than you can afford when inflation protection is added, ask your agent to run a cost comparison between increasing your coverage vs. adding more inflation protection. Then assess whether either is worth your consideration.

Bottom line.

FINALLY! She got to the bottom line.

Knowing the market price of long-term care services, comparing those costs to the level of coverage the policy offers, and, finally, evaluating how well the policy will keep up with inflation are three important ways to evaluate how good a prospective policy is. None of these insurance companies are in business to lose money. Make sure you get your money’s worth.

Coming up.

In a forthcoming post we’ll discuss self-insuring your own long-term care. It may not be as out of reach as you think, particularly if you’re a homeowner. (We’ve already discussed what to do if the cost of long-term care insurance is out of reach.)

In the meantime, stay well and thanks for dropping by.

You got this.

$$$

Long-Term Care Series (Oldest to Newest)

- Long-Term Care Insurance: Five Warnings Before You Buy

- Long-Term Care Insurance Quiz: Will I Need It? Can I Get It?

- 17 Ways to Get Turned Down for Long-Term Care Insurance. (And What Happened to Me.) ** Most popular post on blog.

- Getting Medicaid to (Maybe) Pay for Your Nursing Home Costs: The (Updated) Epic Guide!

- Three Types of Long-Term Care Insurance: You Might Not Need Any!

- Continuing Care Retirement Communities Part 1 —Seven Essential Things to Know

- Continuing Care Retirement Communities Part 2 — Four Ways to Figure Out if They’re Worth the Money

- Continuing Care Retirement Communities, Part 3 — What to Ask Before Signing on the Dotted Line.

- Staring Down Your Long-Term Care Odds–Much Better News Than You Thought.

- How to Evaluate a Long-Term Care Policy. (Hint: Know These Three Things.)

- The Three Factors Affecting Your Long-Term Care Insurance Costs

- My Encounters in the Wild With Long-Term Care Sales Agents.