The takeaway. Out-of-pocket medical bills could be your biggest expense in retirement. Research suggests that over the life of their retirement, a couple can expect to spend an average of $315,000 on such expenses. Below are seven ways to stop the sting, or at least reduce the pain.

$$$

Recently, Mr. Boomer-Money-and-More got into a big fight with a salad.

(You can’t make this stuff up.)

I, myself, have never been on the losing end of a salad fight. As such, I can’t say exactly how it went down. Or more accurately, how it didn’t.

Here’s the aggressor in question–aka the most expensive salad in the world.

It seems a couple of lettuce leaves travelled down the wrong pipe and, so enchanted with the journey, chose to remain in the wrong pipe. Mr. Boomer Money and More spent the night in a private room in the ER, had two x-rays, and was finally discharged at sunrise with a prescription.

This process taught us what some of you Boomers already know and others will learn. Regardless of how extensive your Medicare Parts B, C, and D may be, payment for unexpected health care services costs a bundle.

…a retired 65-year old couple can expect to pay $315,000 in out-of-pocket medical bills not covered by Medicare over the life of their retirement…”

Even when your health care is covered by Medicare, you still pay a healthy percentage in out-of-pocket costs.

Although after 65 your health care insurance is provided by Medicare, your out-of-pocket costs include payments for:

- the various premiums for Medicare coverage, e.g., Parts B, C, and D, as well as

- costs not covered by most Medicare policies, like most dental procedures, routine eye exams, hearing aids, copays, and coinsurance.

According to Fidelity Viewpoints, a retired 65-year old couple can expect to pay $315,000 in out-of-pocket health care costs not covered by Medicare over the life of their retirement. If you’re single, divide this number in half.

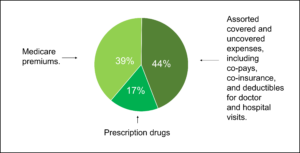

Figure 1 below shows just where that $315,000 will likely go. (These costs exclude long-term care.)

Figure 1. How a Couple’s $315,000 in Out-of-Pocket Medical Bills are Spent in Retirement.

Source: How to plan for rising health care costs, Fidelity Viewpoints, August 2022.

Seven ways to stop the sting of retirement’s out-of-pocket medical bills.

Given that barely half of Americans can handle an unexpected bill of $500, how are we to plan for a retirement that will cost us north of $300,000 in out-of-pocket medical bills? Here are seven steps to stop the sting–or at least reduce the pain–of retirement’s out-of-pocket medical bills.

#1. If you’re still working, set up an Health Savings Account (HSA)

I gotta get out of here! This place is costing me a bundle!!

Health Savings Accounts (HSAs) let you set aside money on a pre-tax basis to pay for qualified medical expenses. You can set one up through a qualified health plan offered at your work or via the private marketplace. Money in the account accumulates tax-free. Best of all, when you change jobs or retire, you can take it with you to pay those out-of-pocket medical bills. (Check with your employer’s Human Resources office for the particular requirements of your health plan.)

#2. Harvest the equity of your home with a reverse mortgage

If you own your own place, (house, condo, townhome, etc.), you may have sufficient home equity to use money from a reverse mortgage to cover your out-of-pocket medical bills expenses. Reverse mortgages allow you to convert roughly 50% of the equity in your primary residence–up to $970,800–into cash. If your home is valued at more than $970,800, your reverse mortgage will nonetheless be treated as if the house is valued at $970,800. You’ll be able to convert 50% of the equity you have in your home against that $970,800 value.

You must be 62 to qualify and must re-pay the lender when you (or your surviving spouse) sell or exit the home for more than 12 months. Most reverse mortgages are Home Equity Conversion Mortgages, known as HECMs, and are insured by the Federal Housing Administration (FHA). You may want to make sure that’s the case if you decide to get one.

Harvest the equity in your house to pay out-of-pocket medical bills.

Alternatively, your heirs can pay off the loan and, with proper estate planning by you, lay claim to the house themselves. (Always consult an estate attorney.)

By far, the clearest article I’ve seen on reverse mortgages was written by Susan Garland for the New York Times. (It’s behind a paywall, but worth getting your hands on–by hook by or crook.) Noted finance writer, Jane Bryant Quinn also does a credible job of describing reverse mortgages in her book, How to Make Your Money Last, as we discussed here.

Here’s some additional information as you conduct your own due diligence:

#3. Delay Social Security and increase Uncle Sam’s payments to you by 77%

If you’re unsure about the viability of Social Security, check out this previous post and use this quiz to further assess your thoughts about filing late, early, or right on time. Based on your quiz results, consider the high rate of return you’ll earn if you choose to delay your benefit. Here’s the low-down with an example from Fidelity Viewpoints and a personalized calculator specific to your very own earnings.

But first, a few facts…

Eligibility for full Social Security benefits, (called your “full retirement age”), is age 67 for someone born in 1960. However, you can file for a reduced benefit at age 62. But, if you forego collecting Social Security at 62, and instead wait until 67, Uncle Sam will increase your monthly payments by 43%. If you wait until age 70, your monthly payments will increase by 77%.

77%!!

See how your rate will increase by using this Social Security calculator provided by Uncle Sam. (If you have trouble with the calculator, call your local Social Security office who’ll give you the information over the phone.)

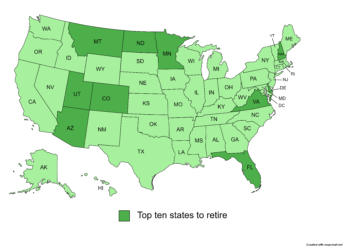

#4. Retire to a state where your money goes farther.

The good folks over at WalletHub.com ranked each state according to its affordability, quality of life, and health care. Here are the top ten states that could take some of the sting out of those out-of pocket medical bills.

Florida

Florida- Virginia

- Colorado

- Delaware

- Minnesota

- North Dakota

- Montana

- Utah

- New Hampshire

- Arizona

#5. Turn your hobbies into money-makers

Some Boomers I know are padding their wallets by:

- working as certified personal home chefs;

- selling jewelry, art, and crafts at week-end festivals;

- teaching group exercise classes tailored to Boomers;

- working as personal trainers; and

- sharing their home through Airbnb rentals.

Turn your hobbies into money-makers.

No appeal?

How about these ideas offered by the folks at Krazy Koupon Lady:

- selling photographs to places like Foap;

- selling sewing and quilting on Etsy;

- selling refurbished and refinished furniture on Craigslist; and

- buying cars at auction for peanuts and then flipping them for a handsome profit.

#6. Consider a part-time job.

#7: Pay attention when politicians talk about cuts to Medicare

Yes, this is a brief–and nonpartisan–foray into politics, but your wallet will thank you.

Whether you’re apolitical or a raving partisan, pay attention when politicians talk about cuts to Medicare. Trust me on this: there will be zero discussion about direct cuts to your benefits. Zero. (They don’t dare.)

Think twice, Buddy. We voted you in, we’ll vote you out.

Instead, listen for proposed cuts to other aspects of Medicare–like to how much money they’re willing to pay doctors and hospitals that accept Medicare patients. In situations like these, the law of untended consequences can easily result in your costs increasing.

During my twenty-six years working for the Florida legislature I saw time and again taxpayers and consumers being forced to pick up the tab for program cuts originally unintended to affect them. AARP keeps its eye on issues like this as well.

Fortunately, we Boomers have big numbers, to marshal big votes, against big politicians who negatively affect our health care. It’s our superpower.

You’ve got options.

So in sum, you can strategize about retirement’s out-of-pocket medical bills to reduce the sting. Do your own due diligence and remember: you’ve got options. At least seven of them. Probably more. So power on.

You got this.

(PS. And be on the alert for aggressive salads looking to pick a fight.)

$$$