The takeaway: In deciding whether to self-insure your own long-term care, it helps to know that 77% of men and 68% of women will either never need long-term care, or if they do, will need it for less than one year. But, if you’re in that group that needs long-term care, you’ll need it on average for two to four years, depending on your cognitive health and gender. On average, two-to-four years will cost between $200,000 and $500,000 at today’s prices.

$$$

In one of those now-or-never moments, a reader wrote that she just bought her dream car–a fully-loaded, top-of-line Lexus. (There are some condos in my town that sell for less.) She knew what she wanted and bought it as a reward for surviving the rough and tumble auto industry, where she’d been an executive her entire career.

Looking for a new car is a lot like looking for the best way to self-insure (i.e., “self-fund”) your own long-term care.1 You’re essentially in search of a commodity. With a new car you ask:

- What are new care prices?

- Do I

wantneed a new car? - Do I like the cars I can afford?

- Where can I get it the cheapest?

For long-term care, whether you self-insure or buy insurance, the questions you ask aren’t that different.

Consider this post your Kelly Blue Book for self-insuring long-term care.

Here are the four questions to ask before deciding whether to self-insure your own care.

- What’s the price of long-term care?

- What are the odds I’ll need long-term care?

- How many years can I self-insure at today’s (and tomorrow’s) prices?

- Are there better options or cheaper alternatives?

We’re not talking about that three-month recovery from your roller skating caper!!

Sidebar: When we’re talking about long-term care, we’re talking about care you pay for–not that three months of free care cousin Tiffany provided when you took that tumble at the roller rink.

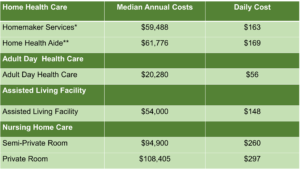

#1. What’s the price of long-term care?

Prices for the various types of care are shown in Table 1.

Table 1. National Median Long-Term Care Prices.

*Based on 5 days per week 52 weeks.

**Based on 44 hours per week 52 weeks.

Source: Cost of Care [Nationwide] Survey, 2022 by Genworth Financial, Inc., January 2022. Click here for costs in your state.

American Association of Long-Term Care Insurance, (AALTCI.org) 2022.

Insurance companies commonly track the percentage of their customers receiving care from home health aides, assisted living facilities, and nursing homes. In 2022, the trade group American Association of Long-Term Care Insurance reported that for each type of long-term care:

#2. What are the odds I’ll actually need long-term care?

Table 2 shows the highlight reel of an earlier post that provides extensive information for assessing your odds of needing care. The table below highlights U.S. Health and Human Services’ projections for folks needing long-term care. These projections are for the percentage of folks turning 65 between the years of 2020 and 2024 that will need paid long-term care.

Table 2. Length of care and percent probability you’ll need long-term care.

Note:These data are based on statistical modeling techniques developed by the Urban Institute that rely on demographic data from the likes of Medicare, Social Security, and Labor Statisitics, as well as data from the private sector. They account for about 17 million Boomers who will turn 65 between 2020 and 2024.

Source:“Long-Term Services and Supports for Older Americans: Risks and Financing, 2020.” ASPE Research Brief, HHS Office of the Assistant Secretary Planning and Evaluation of Behavioral Health, Disability, and Aging, January 2021.

As you can see 77% of men and 68% of women will either never need paid long-term care, or will need it for less than one year. If you’re like the majority of folks in the general population, your chances of needing long-term care are relatively small. But if you fall in that minority needing care for more than a year, research shows you’ll need care for two-to-four years, on average. This two-to-four-year time period is based on insurance claims filed by over 200,000 long-term care insurance recipients and reported by eight large insurance firms.

“If you fall in that minority needing long-term care, research suggests you’ll likely need it for two-to-four years on average…[and]… pay between $200,000 and $500,000 in today’s prices.”

#3. How many years can I self-insure my own long-term care at today’s and tomorrow’s prices?

Today’s prices.

If you plan to self-insure your care for the average two-to-four years that those requiring long-term care typically need, then you’ll spend between $200,000 and $500,000 at today’s prices. Table 3 shows how far your money will go to hit that two-to-four year period. For example, if you set aside $200,000, your money will buy:

-

- 3.24 years of care from a home health service (column B);

- 3.7 years in assisted living (Column C); but only

- 1.84 years in a nursing home (Column D).

Table 3. Number of years of care your money buys at today’s national median prices.

Note: The above are median national prices. Click here for the costs in your state and evaluate accordingly, doing your own due diligence.

Source: Cost of Care [Nationwide] Survey, 2022 by Genworth Financial, Inc., January 2022 and author calculations.

That $200,000 is in the ballpark, but on the low-end of buying you two-to-four years of care that research suggests you might end up needing.

Similarly, if you set aside $500,000, your money will buy

- 8.09 years of care from a home health service (column B);

- 9.26 years in assisted living (Column C); but only

- 4.6 years in a nursing home (Column D).

I can’t believe $200K is on the low-end of what I’ll need to self-insure my long-term care!

Your $500,000 may well over-estimate how much you’ll need for home health and assisted living, but would give you between four and five years in nursing home care. And if you have concerns about dementia or Alzheimer’s, you may be happy you have nursing home funds available. (Alzheimer’s typically lasts four years, but can last longer.)

Tomorrow’s prices.

If you delay setting up a fund for your long-term care, you’ll likely find prices have increased by the time you need to start paying for care. Table 4 shows the percentage that long-term care prices are rising each year. As you can see, home health has the highest percent increase, showing average increases of 5.92% a year. At this rate, we can ballpark prices doubling in 12 years, using the Rule of 72. To avoid this calamity, you’d want your self-insurance money set aside in a “safe investment” that matched the rate at which long-term care is increasing. (Did I already say do your own due diligence?)

Table 4. Average annual price increases for the differernt types of long-term care.

Source: Cost of Care [Nationwide] Survey, 2022 by Genworth Financial, Inc., January 2022. Click here to see average price increases for your state.

#4. Are there better options or cheaper alternatives to self-insure my own long-term care?

$200,000 to $500,000 is a lot of dough to self-insure for my long-term care. Bring me options and make it snappy.

The good news is that you loveable loyal readers already know your options and alternatives because you’ve read this blog’s in-depth long-term care series. But for you hell-raising heathens who’ve skipped class, review below what the loveable loyals already know. As with everything in life, no option is perfect. Take a gander, see what you think, and do your own due diligence.

Option 1. Assess your odds of needing long-term care.

Although earlier you saw the highlight reel assessing your odds of needing long-term care, you may now want to take a deeper dive and really, really, consider your odds by checking out two posts. The first post provides a lot of information so you can better guesstimate your odds. The second is a self-assessment quiz that you can use to supplement the first.

Option 2. Hope and plan for Uncle Sam to pay your long-term care bills.

Familiarize yourself with this post’s discussion of MediCAID, and consider a consultation with a certified elder law attorney to see if you qualify for the program. Medicaid is like the US tax code: highy complex and poorly written. Those with fancy attorneys come out ahead, regardless of how the law reads to the rest of us mortals.

Option 3. Buy long-term care insurance.

Go away! I’m studying the pros and cons of buying insurance for long-term care.

If you go this route, understand:

- the limitations and risks of long-term care insurance;

- the three types of long-term care;

- how to tell if a prospective policy is any good;

- factors that drive up a policy’s price; and

- the 17 ways to get turned down by long-term care insurance companies.

If you plan on getting long-term care from your local continuing care retirement community, know:

- essential facts about continuing care retirement communities;

- how to tell if they’re worth the money; and

- what to ask before signing on the dotted line.

Be wise, Grasshopper.

The reader who wrote to me about her fully-loaded Lexus said her plans for that car were to have have fun, fun, fun, til they take her license away. She seems happy knowing that she’s not only met her transportation needs, but checked off one more item on her bucket list.

Before you sacrifice items on your bucket list, take your time and evaluate your options. Most people spend months researching a new car purchase. This decision is bigger. Give it some thought.

And remember to do your own due diligence.

You got this.

$$$

Footnote 1. A note for you awesome overachievers. If you’ve ever experienced the pain, heartache, and urge to throw yourself out of a moving car while sitting in a “risk management” class– i.e., an insurance class–then you understand that the term “self-funding” is preferred over the term “self-insuring,” since the technical process of insuring involves scintillating topics like statistical analysis of insurance premiums, risk pooling, actuarial science, etc. This post uses self-funding and self-insuring interchangeably because both entail a person paying all their own costs with zero help from insurance. Apologies to you lovable risk managers in the insurance biz. 😉

$$$