The takeaway: The book, How to Make Your Money Last, is a reference guide for any number of personal finance topics relevant to retirees and retiree wannabees. The book hits all the retirement highlights. As always with Jane Bryant Quinn, the book delivers the goods.

$$$

Jane Bryant Quinn is an American treasure. She’s had a long and distinguished career as an author as well as a personal finance columnist for Newsweek, the Washington Post, Bloomberg, and AARP, to name a few. She could hang up her keyboard and rest on her laurels.

Instead, she continues to give us the gift of her counsel.

Today’s book review is:

Making Your Money Last: The Indispensable Retirement Guide.

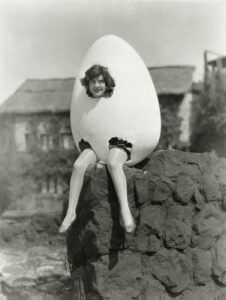

Hey, gorgeous! How ’bout we discuss the salient points of this book, “Making Your Money Last.”

Unlike her encyclopedic, 934 page tome, Making the Most of Your Money, (which was superb), this book concentrates solely on retirement finances. Weighing in at a mere 386 pages, it serves as a reference guide to any number of personal finance topics relevant to retirees and retiree wannabees.

This is not a book you sit down and read from start to finish—although you could and I did. It’s a reference manual for any number of retirement money issues you might need addressed. Don’t expect interesting stories about how Mary Margaret was suffering from financial calamity, tried a certain financial solution, and now lives happily ever after.

This book is meant to inform, not entertain. As is always the case with Jane Bryant Quinn, it’s mission accomplished.

The book hits all the retirement highlights.

Social Security.

Fine! Friends are the best social security. (But nothing beats dough from Uncle Sam.)

The Social Security chapter serves as a 40-page primer on this Goliath government program. It provides tips on how to maximize what you get. Wondering how being divorced, disabled, or widowed effects your Social Security? She’s got it. This chapter will provide most people with a decent road map for navigating this beast with its 2,728 core rules.

She even throws in how to talk with the folks at the Social Security office, which is a don’t miss section. (If you have a particularly thorny issue not covered in this chapter, you can check out Get What’s Yours: The Revised Secrets to Maxing out Your Social Security. I own it, found it helpful, and, as always, receive no compensation for this mention.)

How to maximize your pension-–or buy one.

If you’re lucky enough to have a pension, she’ll help you figure out whether you should take it in a lump sum payment or collect it monthly. If you don’t have a pension, she tells you how you can buy one via an immediate annuity. Immediate annuities can provide you with that monthly paycheck. (Stay tuned for an upcoming post that will cover immediate annuities.)

Ok. Maybe ya shoulda thought of this stuff earlier. But you’re still doin’ better than cousin Vinny ever did.

Nothing is perfect, and neither is this book. Her discussion of equity indexed and variable annuities, both of which are highly complex, is likely not the clearest for most. These annuities are popular with sales agents because they come with large commissions. However, their expensive fees, unfavorable tax treatment, and substandard investment returns often leave something to be desired for consumers.

(Before you buy an annuity, or even consider one, you might want to know the 11 critical questions to ask first and how to get out of a lousy annuity.)

How to not outlive your money—the 4% Rule and the bucket strategy.

As a matter of fact, I *do* know how big my nest-egg needs to be! It’s called the 4% Rule.

If you don’t want to outlive your money, you really need to understand the 4% Rule. Quinn provides a nice discussion of it here, which I highly recommend. You lovable overachievers know we’ve covered the 4% Rule, but let’s face it, two heads are better than one. Give her take a read.

My only caution with her take is this. A target withdrawal from your savings of more than 4%, which she floats as a possibility, is likely too high to sustain your nest-egg, as research also showed in this post here. See Table 1.)

She does a nice job of explaining why stocks, i.e., low priced index funds, are the engine that will grow your nest-egg, while bonds will keep it from splattering to smithereens. Long time readers will recall we’ve extensively discussed this as well in the asset allocation series (right sidebar).

If the stock market scares you too much, she has a nice section on what’s called the bucket strategy. This strategy entails the deft use of cash to protect you against the market’s volatility, while also letting your investments in stocks and bonds grow.

Nope! This is not the bucket strategy that lets you sleep at night because you’re not worrying about the stock market.

She also does a nice job of explaining why your investment returns depend on your asset allocation and—not to be minimized—the fees you pay.

Her section on long-term care is a little on the light side. But then again, Boomer, who else has called out the long-term care industry like I have–using their own data? (See the long-term care series on right side bar. Think long and hard before you start writing those checks.)

Everything else money.

She has a helpful chapter on maximizing your health care benefits and provides some Medicare cost saving tips.

If you’re called to glory, leaving behind a traditional IRA or Roth for your beneficiaries, she’s got it covered. She’ll tell you how to set things up, in advance, so your beneficiaries enjoy minimal tax burdens on that money. Do not miss this small but mighty discussion—it’s in Chapter 7. Your loved ones will thank you.

Here it is right here, knuckleheads: how to set up your IRA and Roth so your beneficiaries avoid losing it all in taxes! How many times I gotta show ya this?

Her primer on bonds is one of the best I’ve seen for the lay reader. She concludes with how to harvest money out of your house with a reverse mortgage and the line of credit that often comes with it. She finishes with the dreaded topic of life insurance and then wraps it up with a summary of the entire book.

Bottom line.

This book helps you maximize the money you’ve got, so it lasts as long as you do. It’s a “just-the-facts-ma’am” reference guide, supported by research. It’s the high quality offering we’ve come to expect from Jane Bryant Quinn.