The takeaway: To not outlive your money you need to know three things. This post covers the first thing: how long you need the money to last. Life expectancy tables, DNA, and X-rays aren’t necessarily destiny. Don’t underestimate how long your money should last.

$$$

Greetings, Boomer. Last summer I was eating a family lunch on the craggy coast of Maine. Out of the blue, my cousin Vinny–not his real name–blurts out, “I just want my financial planner to tell me if I can retire.”

What he was really asking was, ‘Have I set aside enough so I won’t outlive my money?’ “

But listen, gentle Boomer. Sometimes we don’t really want the answer to that question. It might cast shade on the choices we made or what the cruel fates have wrought. (Don’t remind me.) But when you feel ready for that answer, here it is.

Know these three things to not outlive your money

- Based on your health and family history, how long you suspect you need the money to last;

- How much income you require;

- How willing you are to rob banks on an annual basis.

Boomer, full stop, rephrase. The third thing you need to know is how big a nest egg is required to generate enough income to cover your expenses.

This series will answer each one of these questions. Here’s the first one.

Know how long you need your money to last.

Don’t be too sure about lights out at the ballpark!

This is both the easiest and hardest question to answer. None of us knows for sure when the party ends. But government actuaries have a ballpark idea. (And I do mean “ballpark.”)

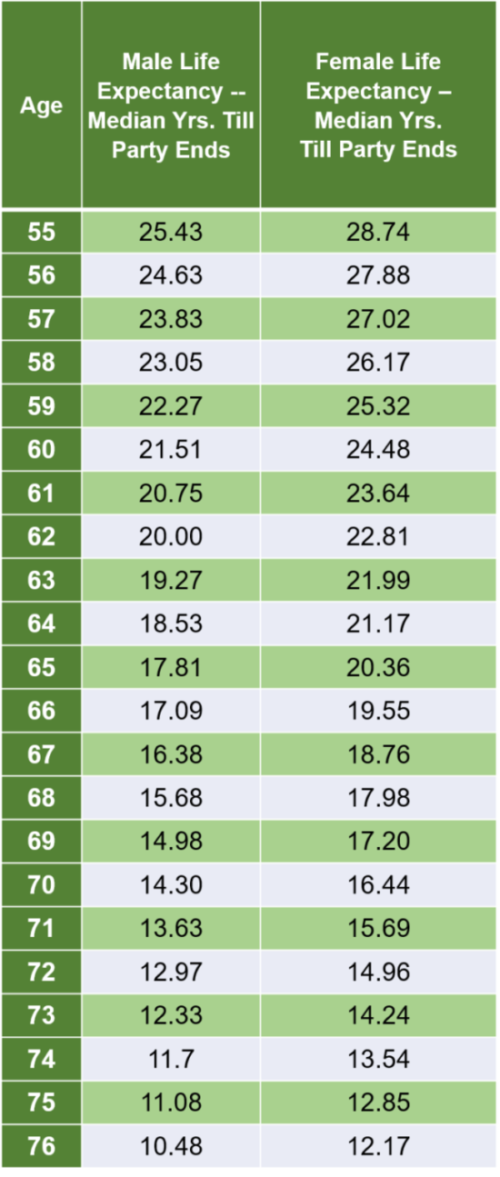

Below are actuarial life expectancy tables issued by the Social Security Administration (SSA). These data are for 2015, the most current data in use by Social Security at press.

The Social Security Administration uses these data as part of its calculation for funding Social Security and issuing your Social Security check.

Boomer Life Expectancy Tables

Source: Social Security Administration Life Expectancy Tables.

50% of folks will live longer than these tables!

50% of folks will live longer than actuaries predict.

As you can see, if you’re a 65-year-old woman, the table shows you’ve got a median of 20.36 more years to live—until you reach age 85.

Recall, my dear stat-nerd, that median means that 50% of people will live longer than the numbers indicated in the table and 50% will cash out sooner. Median is the mid-point.

When you use these numbers to calculate how long you need your money to last, add additional years. Regardless of your circumstances, do it! I say that because…

DNA (and X-rays) aren’t always destiny

When my father-in-law was born, his life expectancy was 57 years old. We buried him in April, two months shy of his 94th birthday. He’d lived a full and vibrant life, the last 30 of which was with chemo and blood cancer. At 89 he flew with us to Germany and tore up the place.

His bride of 60 years outlived her life expectancy by 25 years.

I could go any minute, Boomer.

On the other hand, each generation in my family exits stage left earlier than the generation before it. My maternal great-grandmother lived until 95, my grandmother lived until 77, and my mother lived until age 61. Same thing on my dad’s side.

(I could go any minute, Boomer!)

But, actually, Americans are living longer now. The Journal of Health Affairs reports we’re living longer and healthier than our predecessors. I’m padding my estimates. In fact, I’m hopeful to reverse the trend and live to 100.

You may well live beyond your life-expectancy; make sure your money does too

Science is a wonderful thing, advances we don’t even hear about happen daily, and we could all live longer than we anticipate. Keep it in mind when calculating how long you need your money to last.

Later in this series, we’ll discuss how to figure out how much income you need to retire. Hint: It’s not by taking a set percentage of your pre-retirement spending.

Until next time, Boomer, live long and prosper.

You got this.

$$$