Takeaway: Diversified stock funds can stem losses and enhance returns for your retirement nest-egg. Trees don’t grow to the sky and neither will this stock market. You’ve already seen here how owning both stock and bond funds reduce damage to your nest-egg. You can further reduce damage, not just by diversifying between stock and bond funds, but by also diversifying within selected stock funds available to you.

$$$

Happy New Year, Boomer! We don’t know what the 2020 market will hold. But we do know that in the 2008 Great Recession, there were those who were prepared. Today, they’re sitting pretty.

(You gotta hate ’em.)

If you bring up the 2008 meltdown one more time, I’m going to tear that toupee right off your head.

In 2008, if your portfolio contained a) 50% stocks from the S&P 500 and b) 50% Treasury bonds, when the crash hit:

- your stocks fell by 37%;

- but your Treasury bonds rose by 20%.

- Your bonds protected you from catastrophic loss and you were down an easily recoverable 9%.Why do I say “an easily recoverable 9%?” Because, from the depths of the market in 2008, those who didn’t panic and sell found their stocks up by 344% and their bonds up by 33% by year-end 2019.1(If you sold, gentle Boomer, you were in the good company.) Time makes us all wiser. So let’s get wise right now.

Diversification smooths the ups and downs of financial markets, helping you sleep at night.

What’s the big picture with diversification?

In 2008, if your bonds went up while your stocks went down, you were practicing “diversification.” (Bravo!) Diversification is when different assets, like stocks vs. bonds, respond differently to the same event–like the recession of 2008. (Tip of the hat to Investopedia for this particular definition.)

Diversification smooths the ups and downs of financial markets, helping you sleep at night.

Diversification is when different assets, like stocks vs. bonds, respond differently to the same event, like the recession of 2008. “

Diversification: It’s not just for stocks vs. bonds.

Listen (Mr.) Ed. You can protect yourself, not just by diversifying between stocks vs. bonds, but also by diversifying within your stock mutual funds. That’s just horse-sense!

In the long-term, you can help make sure you’re prepared for whatever the market throws at you. You do this, not just by diversifying between your stocks and bonds, but by building a nest-egg that diversifies stock mutual funds as well.

These are funds in your 401(k), Individual Retirement Account (IRA), Roth IRA, and deferred compensation account–to name a few. Typically, this is money you won’t need for at least the next 5 years. Maybe even 10.

In the long-term, you can help make sure you’re prepared for whatever the market throws at you, not just by diversifying between your stocks and bonds, but also by building a nest-egg that diversifies your stocks. “

How can you diversify your stocks?

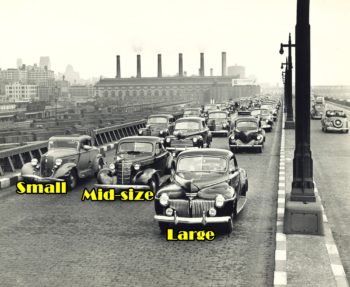

To diversify your stocks, you need to know that stocks are like rental cars. They come in:

Major stocks, like rental cars, come in three sizes: large, mid-size, and small.

- large,

- mid-size,

- small,

- and tin can.

Similarly, stocks are divided into:

- large-“cap”

- mid-“cap”, and

- small-“cap.”

“Cap” is short for capitalization, which is a word that describes a company’s market value. Just as your house has a market value, publicly traded companies also have a market value. In financial-speak, market value is called capitalization” or “cap” for short.

Here’s how large-, mid-, and small-cap companies and their stocks are categorized.

Source: Financial Engines and Investopedia.

Just like your home has a market value, companies that issue stock also have a market value. A company’s market value is called its ‘cap.'”

Why do you care?

Here’s why you care. Because the strategic purchase of large-, mid-, and small-cap stocks, all according to your goals and tolerance for risk, can help protect and grow your nest-egg. When the stock market drops, certain types of stocks within the market don’t fall as far.

Even better, when the stock market goes up, different size stock funds often go up even higher.

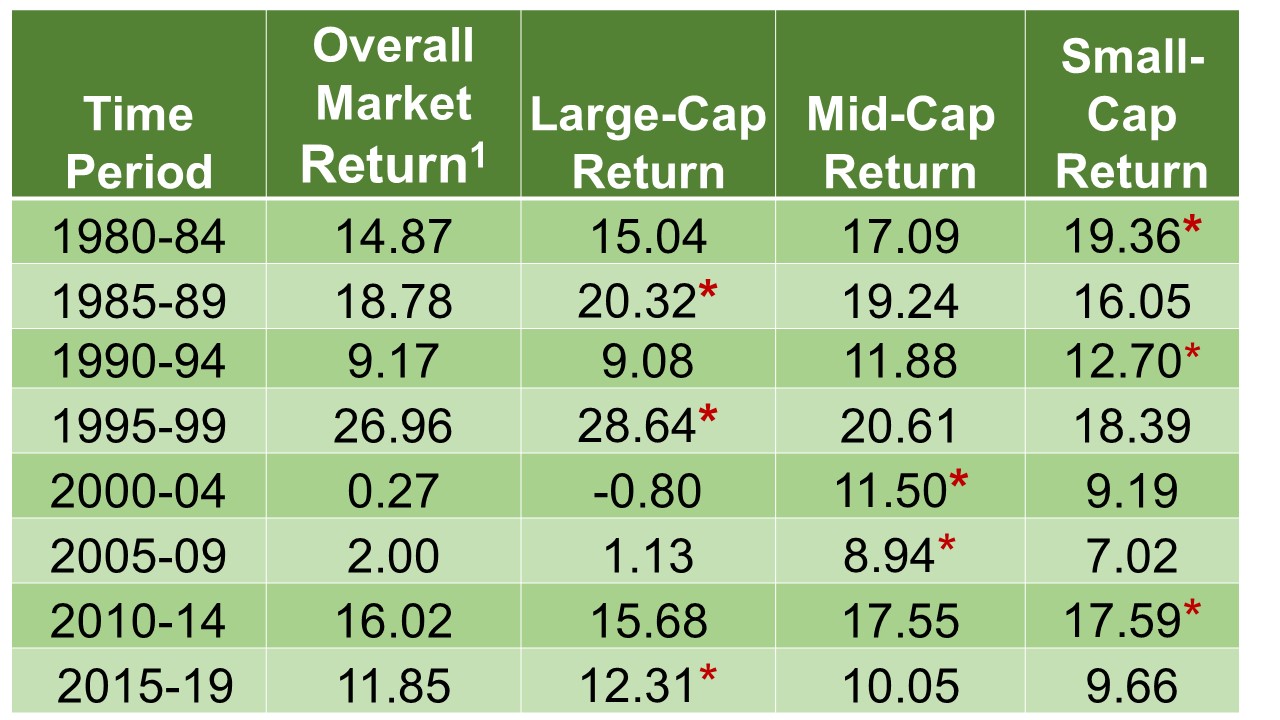

You lovable visual learners can see that from the graph below. (The stock market rate of return is shown by the black bar.)

Graph: When the market is down (black bar), some funds don’t fall as far as the market. When the market rises, some funds rise even higher, exceeding the overall market. It’s all based on whether a fund is a large-, mid-, or small-cap fund.

Source: Portfolio Visualizer from Silicon Cloud Technologies, January 2020.

Table: When markets fall throughout the years, not all funds fall as low. When the market rises, some funds rise higher, exceeding the overall stock market. It’s based on whether a fund is a large-, mid-, or small-cap fund.

Note1. Included in the overall stock market are large-, mid-, and small-cap stocks. These are the most common gradations. However, some analysts break down stocks into even finer gradations. You can see these here.

* In terms of market returns, these were leaders of the pack.

Source: Portfolio Visualizer from Silicon Cloud Technologies, January 2020.Take a look at your nest-egg.

Boomer, we don’t know what the 2020 economy will hold. But we can be reasonably prepared by diversifying our nest-egg. The start of the year is a good time to get our nest-egg on track.

As you review your portfolio, consider the value of diversifying your stock funds. Next month, we’ll delve further into this.

In the meantime, Happy New Year, Boomer!

You got this.

$$$

Note 1. To compare the 2008 value of stocks and bonds to their value today, I used data from the St. Louis Federal Reserve database. These data were compiled by my former UCLA finance instructor–Aswath Damodaran–currently at the NYU Stern School of Business. His worksheet is shown here. I assumed that in 2007, you deposited $1.00 into the S&P 500 index and $1.00 into 10-year Treasury bonds. I then compounded the interest rate of each of these dollars starting in year-end 2008.

For stocks, I compounded the interest rates shown in the worksheet’s column 2. For bonds, I compounded the interest rate shown in the worksheet’s column 4.

Results showed that, for stocks, the initial $1.00 invested had decreased to 63 cents by year-end 2008. That’s an increase of 344% from year-end 2008.. (($2.82 value at year-end 2019 minus 63 cents value at year-end 2008) / 63 cents at year-end 2008) = 344% increase.)

For bonds, that $1.00 initially invested was worth $1.20 at year-end 2008. That’s an increase of 33%. (($1.60 – $1.20) / $1.20 = 33%).

$$$