The takeaway: large-cap, mid-cap, and small-cap stock funds in your nest-egg are ways to stem market losses and enhance market gains. Just make sure that your personality matches the personality of these large-, mid-, and small-cap stocks before you buy.

$$$

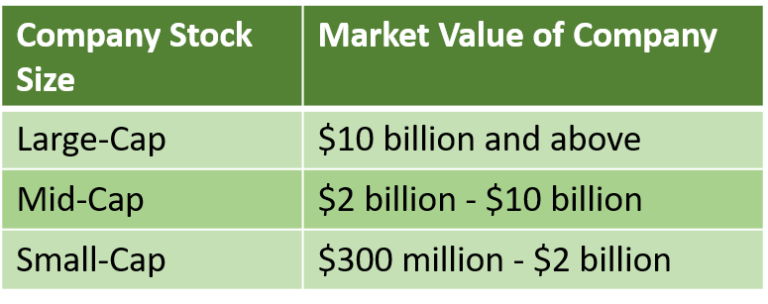

Last month’s post was an affair by the numbers. We looked at 40 years worth of data and showed how we could improve our investment returns in an up-market and reduce our losses in a down-market. We could do so by dividing the stock mutual funds in our nest-egg into large-, mid-, and small-cap stocks.

(As always, when I talk about “stocks” I’m talking about stock mutual funds.)

In a word, and in scintillating detail, we discussed the value of diversification.

What was not to love?

Well, Boomer, to be honest, there was no romance! We evaluated those stocks based solely on their market value.

An affair by the numbers.

Source: Financial Engines and Investopedia.

Kind of like evaluating your dinner companions by the size of their wallets.

Savvy Boomer, these stock funds are more than their wallets, cap size, and market values!

- They have personalities!

- They have attitude!

- They have…(I need to get a life.)

All we had in common was the cap-size of our stocks. I’m not sure we ever understood each other’s personality…

Here’s the thing.

Understand these personalities, and how they mesh with your own, and you’ll make investment decisions more closely aligned to your goals. “

You won’t be rattled when each one responds differently to the same economic or market condition.

How do I better understand large-, medium, and small-cap funds?

Since I’ll need money when I’m older, I guess I’ll master this large-, mid-, and small-cap stock stuff.

A good way to think of each of these funds is to view them as ocean-going vessels on the high seas.

(I know it’s weird, but this works. Please affix your life jackets now.)

The high seas are the overall stock market. Your individual stock funds are the vessels on those high seas. Each one reacts differently in a major storm.

Know how each one reacts and you won’t be rattled when the storm hits.”

Large-caps

Large-cap stocks are like cruise ships. They’re already gigantic in size and won’t get much bigger. They can generally handle most storms they encounter.

Large-caps: the cruise ship of stocks. Whether the oceans are calm or choppy, cruise ships can weather most storms.

Like cruise ships, most large-cap stocks–no matter how beat up they get–can find their way back to shore. They generally can live to fight another day.

Large-caps are mature industry leaders, like Amazon, Apple, and Alphabet (Google).”

Risk. Like all stocks, large-caps have some risk.

Risk is the possibility you’ll lose money.

In fancy pants terms, risk is the degree of uncertainty about an investment return as well as the potential harm that could arise if that investment return falls short of what you expected.

If you put your money under the mattress, you risk that your money will lose it’s purchasing power due to inflation. It will not longer buy you what you expected it would.

I knew we needed to review the concept of risk!

Similarly, if you put your money in stock funds, you risk that in the short-term–a period of less than 5 to 10 years, you’ll lose some money, or won’t get the returns you expected.

Investment returns and fees. Because their market value is just about as big as it’s going to get, these companies are not going to explode in value and grow you lots of money.

Company stocks that explode in value typically do so through increased revenues earned from new services or product lines. Or they do it by increasing their efficiency, often through automation and staff downsizing.

These companies are already operating at full-throttle and are about as efficient as they’re inclined to be.

Holy cannoli! He’s dreamy. But I think he’s only attracted to my large-cap stocks.

Nonetheless, over-time, you still earn more from these companies than you would with bonds or cash.

(Not that your bonds and cash are chopped liver, Boomer. Your cash is for your short-term and emergency needs. And your bonds help provide a floor for your portfolio.)

There are three additional benefits of large-cap stocks investors typically receive.”

- First, they pay you dividends. You can supplement your retirement income with these dividends. Or, you can reinvest them to grow your nest-egg.

- Second, they come with lower fees compared to most mid- and small-cap funds. This is a good thing, since fees kill investment returns.

- Third, you can smugly introduce the concept of “large-cap” stocks,” when physicists at the party start talking about nanowires and magnetoresistance.

Large-Cap bottom-line. Conservative investors who want to grow their nest-egg would typically add large-cap stocks to any bond funds they already hold. The bonds will give their nest-egg relative stability. The large-cap stocks will be the engine that drives their nest-egg growth over a 5- to 10-year period.

Mid-caps

Yachts are like mid-cap stocks. They can more readily reverse course in response to negative events than can large-caps. These stocks have room to grow and make (or lose) you money.

Mid-caps: the yacht of stocks. In major storms, these yachts may get beat up, and in the worst case, capsize. So it is with mid-cap stocks in market storms.

However, compared to large-cap stocks, mid-caps are more nimble and can more readily reverse course in response to negative market events.

Whirlpool, Garmin, and iRobot are examples of mid-cap companies.”

Risk. Mid-caps are more sensitive to market ups and downs than are large-caps. That means that in the short-term, again a period of less than 5 to 10 years, you might well lose more than you would with large-caps.

But you may also make more money than you would with large-caps.

You don’t scare me, you volatile mid-cap horse!

Investment returns and fees. Unlike large-caps, mid-cap companies have room to grow and increase their revenues.

Typically, when they make more money, so do you. The price of the stock you originally purchased goes up, driven by new investors who want in on a company growing in market value.

Bulletin: in evaluating mid-cap funds, it typically pays to pick the fund with the lowest fees. Why? Again with feeling: fees kill investment returns.

Mid-Cap bottom-line. Investors comfortable with the relative short-term ups and downs of financial markets will appreciate the relatively high investment returns these funds potentially provide over the long-term–particularly if they’re index funds. These investors will be undeterred by the down periods that can ensue in the short-term.

Small-Caps

This motorboat is like a small-cap stock. On the high seas, it flies high over ocean swells and can disintegrate on impact during major storms.

Small-cap: the motor boats of stocks. These boats can fly high over ocean swells on the high seas, and disintegrate upon impact when waves crash.

Small-cap stocks include companies you may well have never heard of.”

Risk. Small-caps are risky, i.e., they’re highly volatile. They’re highly sensitive to market conditions. If the market tanks, they can suffer cash flow problems, lose customers, lose investors, and die a premature death.

Investment returns and fees. Investors who can get past their volatility will find small-cap funds have amazing potential to post massive percentage increases in up-market investment returns. This is because they are starting from such a low market cap, ($300M to $2B). (See the table shown earlier.)

No worries. He’s evenly diversified between large-, mid-, and small-cap funds. Show off!

This is analogous to the relative ease of doubling a $6,000 salary vs. the difficulty of doubling a $600,000 salary. A $6,000 salary starts from a smaller base.

Fees for these funds are higher than the fees of mid- and large-cap funds–somewhat reducing their investment returns.

Small-Cap bottom-line. Caution is advised here. The volatility of small-cap stocks is best balanced with the relative stability of large cap stocks.

Large-, Mid-, and Small-Cap stocks–bottomest of the bottom lines.

Boomer, we are in the midst of an unusually long bull market that began in 2009 and is still rolling. We don’t know how long it’ll last.

But we do know this: trees don’t grow to the sky. Unless nearly 100 years of financial data are wrong, neither will this stock market.

These are the trees in my backyard. They’re not going to grow to the sky, Boomer! Neither will this stock market.

Diversifying between stocks and bonds can help stem your (temporary) losses when the market “corrects,” i.e., “falls.”

Stocks go up and down, while bonds plod along.

But over a 20 to 30 year retirement, it’s stocks that’ll drive the growth of your nest-egg, as was shown here.

You may feel like you’re perfectly content to simply own, say, a large-cap S&P 500 fund and some Treasury bonds and call it a day. Done.

Or you may decide you want to further protect all your nickels and dimes. You want to stem losses and enhance returns even further by owning large-, mid-, and small-cap funds.

This is a question of personality and how involved you want to be in dividing up and monitoring your assets.

Do you want to swing for the fences with small-caps, betting on a home-run but risking a strike out? Or do you prefer the stalwart market leaders of large-caps?

How about those growth magnets called mid-caps? How about all three for the true protection of diversification?

It all depends on your personality. And your penchant for roller coasters.

There’s no shame either way.

There’s no shame either way.

At a fundamental level you know which approach matches you best.

You know which approach will help you sleep at night and simply yawn when CNBC starts shouting about market Armageddon.

You now you have a clear-eyed view of what you’re choosing and why.

In fact, you got this.

$$$