The takeaway: There are 11 critical questions you’ll want to ask before you buy an annuity. Played right, annuities can alleviate any fear you might have of outliving your money. Played wrong, and you’ve needlessly parted with a lot of cash. Annuities are simple in concept, but the devil’s in the details.

The takeaway: There are 11 critical questions you’ll want to ask before you buy an annuity. Played right, annuities can alleviate any fear you might have of outliving your money. Played wrong, and you’ve needlessly parted with a lot of cash. Annuities are simple in concept, but the devil’s in the details.

$$$

Part 1 of a series on annuities that will appear here from time to time.

$$$

I have it on good authority that a healthy minority of you feel like life’s too short to worry about the stock market. The ups, the downs, the Maalox moments. You’re over it.

If you wanted to be jerked around like this, you’d stay at work and let them pay you for the privilege.”

Hey! This ride’s too bumpy! Get me off! I’m ready for an annuity!!

You don’t care that over time the market may average 10% a year. You’re tired of the bumpy ride.

And you don’t want to wait one year, or one decade, for that 10% to finally average out.

I hear you reprobates loud and clear.

Today we launch the scintillating, sparkling, and sometimes scandalous topic of annuities.

Annuity road map.

This post discusses the 11 most critical annuity questions, the answers to which will spare you needless separation from your money. Later posts will cover:

- how to get out of a lousy annuity (which the 11 critical questions may prevent you from buying in the first place);

- how to avoid buying an annuity headed for bankruptcy; and

- the pros and cons of the annuity fab four:

- single premium immediate and longevity annuities;

- fixed annuities;

- equity-indexed annuities; and

- variable annuities.

Annuities and my young life with strangers on the Greyhound.

Annuities are kind of like the Greyhound Bus of “investments.”

So let me digress by telling you that when I was an undergrad, every few months I’d take the Greyhound Bus from San Diego State to my family home in Long Beach.

When it was time to take the bus back, my mom’s parting salvo was always, “Don’t talk to any strangers.”

Hey, stranger! Wanna sit by me? It’s a long ride and we can talk annuities!!

I, of course, talked to plenty of strangers.

But there were strangers I wouldn’t talk to–no matter how attractive they looked or how nice they seemed.

Even though there are plenty of attractive looking annuities, sold by nice annuity sales agents, things can go very wrong very fast.

Just like on Greyhound.

But also like Greyhound, annuities can get you where you want to go.

Your job is to discern which is which, and who is who. Mine is to provide you an unvarnished look at annuities while whispering in your ear, “don’t talk to any strangers.”

Who’s that Boomer calling us Boomer?

Onward, savvy Boomer!

1. What’s an annuity?

An annuity is an insurance policy you buy to protect yourself against outliving your money. At a specified point after you buy, the annuity company pays you back your purchase price—with interest—for a designated period of time.

They can start to pay you immediately, or they can defer payment until a time of your choosing. How much you get back depends on how much you pay in.

Sounds simple, but like life, the devil’s in the details.

2. What are the fab four of annuities?

There are generally four main types of annuities you can buy. In Table 1 below, they’re listed from least to most expensive.

Should any of these appeal to you, a future column will discuss the pros, the cons, and how these annuities might complement your current nest-egg. (And maybe help you sleep at night.)

Table 1. The John, Paul, George, and Ringo of Annuities.

Source: Financial Industry Regulatory Authority’s six-part series on annuities; 2016 ; Money.CNN.com; The Ultimate Guide to Retirement: Annuities, 2016.

Consider the information below the barest of bare-naked prerequisites before you consider any specific type of annuity.”

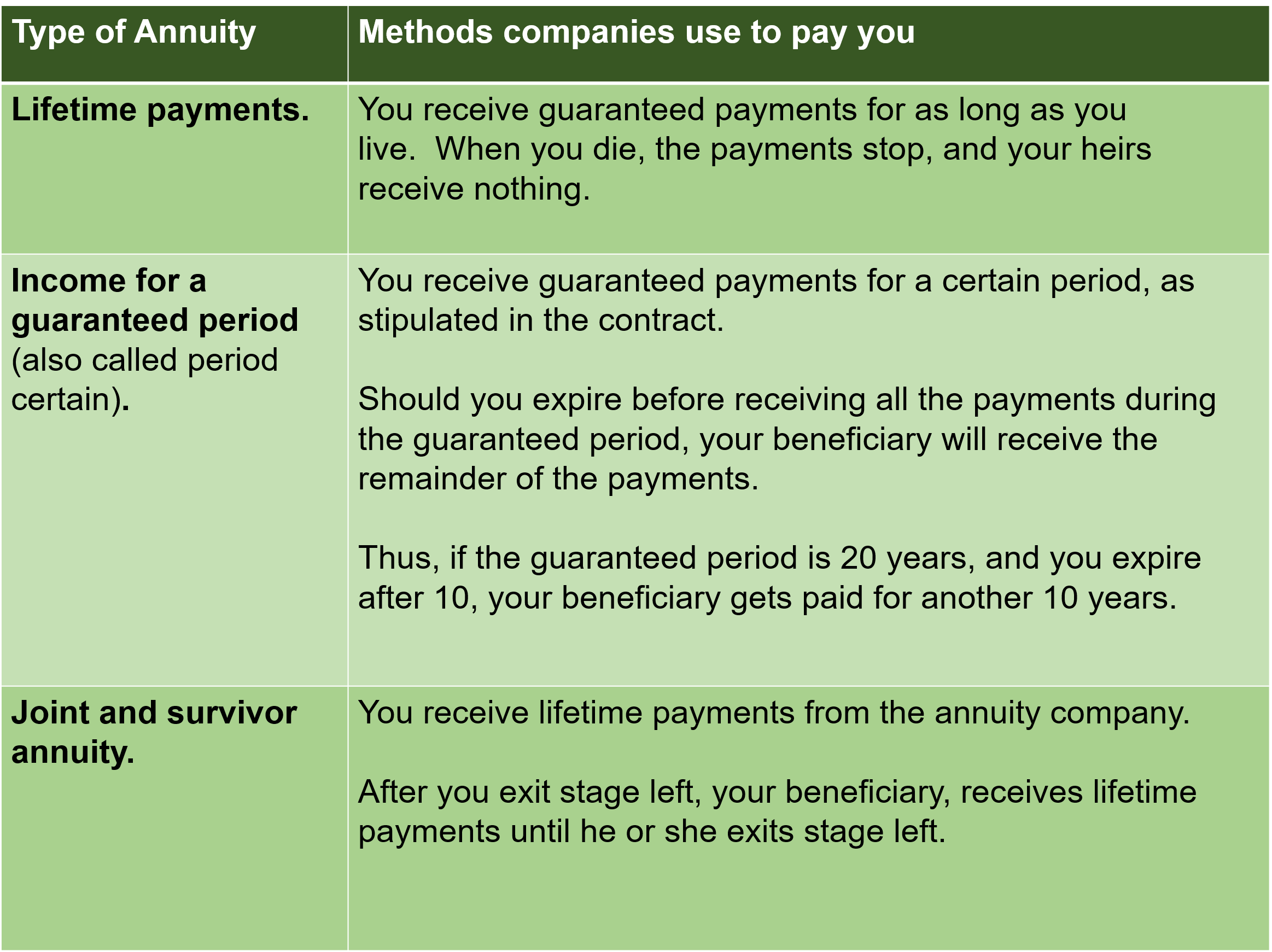

3. How do payments made to me by annuity companies work?

Boomer, regardless of which of the fab four annuity types you buy, the annuity company will pay you back your money, with interest, in one of three ways. Table 2 shows a description of payment methods companies use.

Table 2. Top three methods companies use to distribute your money back to you.

Source: Money.CNN.com The Ultimate Guide to Retirement: Annuities, 2016. Financial Industry Regulatory Authority’s six-part series on annuities; 2016. Gitman, Lawrence J. and Joehnk, Michael D. Meeting Your Retirement Goals, Personal Financial Planning, eighth edition; 1999.

You, earth angel, pick the method you want the company to use.

If you don’t designate a beneficiary, you’ll get the largest payment back. This is because the company knows they don’t have to hold money back to fund both you and your beneficiary. That savings is passed along to you.

Good thing my wife’s annuity left me all this dough! Otherwise, I’d be living with my kids.

In contrast, if after you pass, you want your beneficiary to be paid throughout his or her natural life, you’ll get the least amount of money back.

This is because the company has to hold money back to fund each of your natural lives.

In her book, How to Make Your Money Last, AARP’s Jane Bryant Quinn recommends you choose a payment that provides for your spouse after you exit stage left. Quinn reports that the one left behind, often the wife, is generally left in considerably reduced circumstances if payments stop.

4. What’s the entry level price for me to buy an annuity?

Companies vary, but $30,000 is likely the cheapest you’ll pay and it’ll be for a SPIA–described in Table 1.

I’m ready for my money! Fork it over.

You can go to immediateannuities.com, plug in how much you want to pay for a SPIA, and their calculator will tell you how big your payment back will be.

(Go ahead and check it out. I’ll wait right here.)

You’ll pay more for other types of annuities. Check with your sales agent–after you’ve read this series ?.

5. Where can I buy an annuity?

Annuities are typically sold by

- insurance companies;

- some banks;

- some financial planners; and

- financial services companies like Schwab and Fidelity.

As will become clear over of this spellbinding series, it’s best to think of annuities as insurance products, not as financial investments.

6. How much are the fees companies charge to maintain my annuity?

Don’t look. I see the fee collector from the annuity company swimming up to our boat.

Annuities vary in the fees they charge. Equity indexed and variable annuities are the primary purveyor of fees. Though these fees will be discussed in future posts, here’s a smattering of what you’re paying for.

- Administrative fees are the fees for tracking, investing, and distributing the money in your annuity back to you.

- Rider fees are fees for special features not included in the annuity base price, such as inflation protection, special protection of your annuity principal, guaranteed minimum income benefits, long-term care, etc.

- Surrender fees are the fees you pay if you choose to exit your annuity before the contracts says you can.

The more complex the annuity, the higher the fees you’ll pay. Table 3 lists annuities from least to most complex. Notice the fees increase accordingly.

Table 3. Upfront Annuity Fees and Recurring Fees You’ll Keep Paying Till the Cows Come Home.🐄

Haithcock, Stan. The Costs of Owning an Annuity. American Association of Individual Investors, 2013. Money.CNN.com; The Ultimate Guide to Retirement: Annuities, 2016,

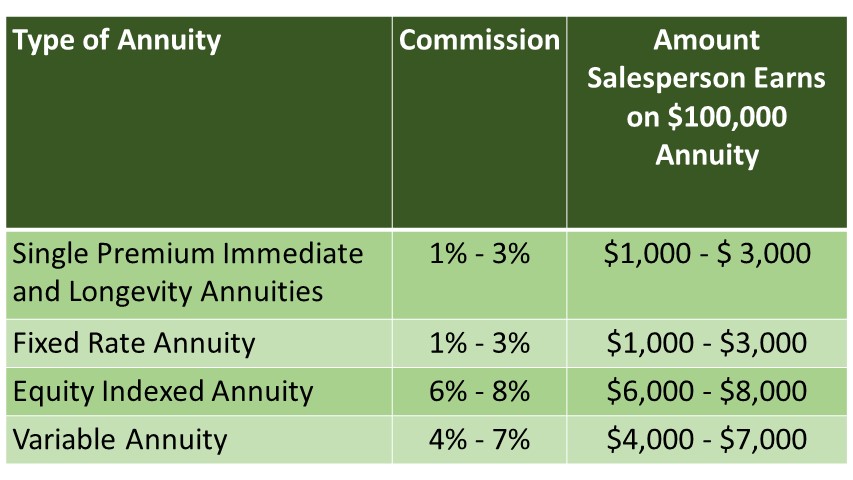

7. How much commission does the sales agent earn?

Boomer, like you, sales agents have bills to pay and dreams to fulfill. As such, they’re awarded a commission when you buy an annuity. The commission is built into the price of the policy and not transparent in the contract. Rest assured, and perhaps rightfully so, sales agents are incentivized to sell you an annuity.

Table 4 shows what they’re typically compensated for the sale. (More on this in next question.)

Table 4. Sales Agent Commissions on Annuities

Source: The Levels of Commission Agents Earn on Annuities, The Balance, 2/17/2020.

8. What’s in it for the annuity company? (Hint: they’re not in it to lose money.)

Boomer, annuity companies hire legions of brilliant actuaries and MBAs who design annuities according to life expectancy projections.

Legions of brilliant actuaries and MBAs embed company profits and sales commissions inside the annuities sold. These corporate goodies are invisible to the naked eye.

The money the annuity company saves on their customers who expire prior to their life expectancy is used to pay those who exceed their life expectancy.

Further, these brilliant actuaries and MBAs embed sales agents’ commissions, and the company’s profits, into the annuity itself.

For equity index and variable annuities, defined in Table 1, it’s virtually impossible to compare one company’s annuity with another company’s annuity–even when the annuity goes by the same name, like “variable annuity.”

Boomer, when you approach an annuity sales agent in the wild, exercise extreme caution. ”

9. If I decide to buy an annuity, what do I need to know about annuity sales agents?

Annuity sales agents are like the bears at Yellowstone. ? To be safe, you’ve got to know how to play on their turf.

And here’s how their turf works: there’s no fiduciary law requiring most sales agents to sell you an annuity that’s in your best interest.

Agents don’t necessarily have to tell you the pitfalls of what you’re buying. Annuities are so complex that the agents themselves may not know what they’re getting you into.

With moderate assist from NAIC, the SEC and FINRA have issued “investor alert” bulletins on pitfalls to avoid when purchasing annuities.

Consequently, the following have all issued investor bulletins to help you traverse the reality distortion field extant in annuity-world:

- the Securities and Exchange Commission (SEC — Investor alert bulletins here, here, here, and here);

- the Financial Regulatory Authority (FINRA — this six-part series lays out the risks, pros, and cons;

- the National Association of Insurance Commissioners (NAIC — buyer’s guides here and here); and

- annuity experts — here, here, and here.

Always ask the sales agent if they’re a fiduciary fiduciary.

Two rules of thumb:

- if it sounds too good to be true, it is;

- if something feels wrong, it is.

10. Are there limits on how much I can contribute to an annuity?

There are no contribution limits. However, annuities are typically only guaranteed for up to $250,000 per company. You might consider buying annuities with multiple companies if you want to pay more than this. (More on this in the next column.)

An annuity is not an investment. It’s an insurance policy. It’s the price you pay to insure you don’t outlive your money. Nothing more.”

11. Are there tax advantages to owning an annuity?

The secret annuity he bought has really taken care of me. Still, I kind of miss the old goat.

Sales agents will argue this, but the overall tax advantages are minor at best. But you, savvy Boomer, know to always consult an independent tax professional on issues like this.

If you’re buying an annuity with after-tax dollars, which is how most folks buy them, you’re taxed only on the interest. The interest accumulates tax deferred. When you receive payment from the annuity company, the interest earned is then taxed as ordinary income. Depending on your tax bracket, ordinary income is taxed as high as 37%.

In contrast, if you spent the same amount of money outside of an annuity, capital gains, like tax paid on stock, bond, and mutual fund earnings, tops out at 20%.

37% tax vs. 20% tax. You tell me which you like best.

Additionally, an inherited annuity isn’t tax friendly for your kids’ inheritance, compared to leaving them the same amount of money in stocks, bonds, and mutual funds.

OMG! She’s not going to talk about that step-up tax provision is she?

Tax-wise, annuities don’t benefit from what’s called a “step-up” provision–unless you want to spend a ton extra.

You lovable overachievers can read about the step-up provision and watch the video here. For everyone else, suffice it to say an inherited annuity is not tax friendly to your kids.

Consult a tax professional, do your own due diligence, floss before bed.

Whew! We got through the 11 critical questions without quite hitting critical condition.

Boomer, you now know more about annuities than the majority of annuity owners who’ve shelled out thousands for a product they never understood. “

Next up.

The next post in this series will discuss how to get out of a lousy annuity. If you already own a lousy annuity, help is on the way. If you haven’t bought an annuity, next month’s post may keep you from needlessly parting with your money.

Either way, you now know more about annuities than the majority of annuity owners who’ve shelled out thousands for a product they never understood.

I’ll see you next month.

Until then, don’t talk to any strangers.

$$$

Annuity Series (Oldest to Newest)

- Annuities: Eleven Critical Questions to Ask Before You Buy (Or Even After You Own)

- Lose Your Bad Annuity Without Losing Your Shirt. (Maybe)

- Annuity Bankruptcy: Don’t Fund Your Retirement with an Annuity Headed for Bankruptcy (Like I Did)! Three Must-Do Actions.

- Immediate and Longevity Annuities: The Cheapest Way to Buy Income for Life — Everything You Ever Wanted to Know

- Equity Indexed Annuities: Beware the Seduction!

- Fixed Annuities: Higher Rates Than CDs. Worth it?