The takeaway: equity indexed annuities allow you to participate in the stock market, with minimal losses and some gains. However, your market gains are substantially limited by fees and contract restrictions. Plus, obscure interest calculations make it hard to verify you’re getting the returns you were promised. Better alternatives exist, so think twice. (Maybe three times.)

$$$

Part 5 in a series on annuities that will appear here from time to time.

$$$

As I nursed my decaf latte, the couple in the booth next to me ordered, ate, and left. Finally, like a hurricane, my long-time friend and former colleague came blowing through the restaurant and plopped down in front of me. He’d been meeting with his financial advisor. She’d just sold him an equity indexed annuity.

You’re gonna love this cake with no calories. You brought your checkbook, right?

“What did she tell you it was?,” I asked. His reply: “When the market goes up, I make money. And when the market goes down, I still make money. In fact, I simply don’t lose any money. It’s like cake without the calories.”

These calorie-free annuities are sometimes called fixed indexed annuities, hybrid annuities, and indexed annuities.

My friend was told he’d get his contract in a few days. I knew the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) had issued investor alerts about these annuities. I also knew these annuities were highly complex.

So my first suggestion was that he go over the contract with a fine tooth comb.

It’s like cake without the calories. “

What’s a cake-without-the-calories equity indexed annuity?

Like most annuities, an equity indexed annuity is a product you commonly buy from an insurance company or a financial services firm like Schwab. The firm holds your money for a specified period of time, and eventually pays back your purchase with interest.

Let’s start out on a positive note about equity indexed annuities. Shall we?

The interest is tax deferred, meaning you pay no taxes on the interest until you start withdrawing money from the annuity.

How does my equity indexed annuity earn interest?

Your annuity earns interest from two sources:

- a fixed annuity interest rate that’s contractually promised and typically pays annuity interest of between 1% to 3%, and

- annuity interest earned from the stock market.

Annuity stock market interest is typically measured by the S&P 500 index. The interest your annuity earns from the stock market will nearly always be less than whatever the S&P 500 index posts. How much less is based on the “interest rate caps” imposed by the annuity firm and discussed in a later section.

Your other annuity interest source, i.e., the contractually guaranteed fixed interest you’re promised, earns interest on roughly 90% of your premium. As such, if you buy an equity indexed annuity for $100,000, you’re contractually guaranteed to earn fixed interest on about $90,000. (90% of a $100,000 annuity = $90,000.)

What happens to my annuity interest when the stock market falls?

We have each other and our equity indexed annuity. Could we be any happier?

When the market falls, the losses on your annuity stock market interest are limited by a buffer or a floor.

A floor is the point below which your annuity stock market interest will fall no farther. For example, if you have a floor of 0%, and the market falls 30%, your annuity stock market interest will be 0%. In short, you suffered no stock market losses.

If your annuity contract provides for a buffer, much less commonly used, then you are provided a hedge against how low your annuity stock market interest can fall. For example, if the market falls 15% and you have a buffer of 10%, you’d post a return of 5%. (15% market fall – 10% buffer = 5% posted for your annuity stock market interest.)

What’s the upside of these equity indexed annuities?

The upside is they provide you with annuity interest earned by the stock market, while also protecting you from stock market losses. Further, they contractually guarantee you’ll earn a modest fixed interest rate.

The problem is on the downside.

Spoiler alert! This is the real world not Fantasy Island.”

What’s the downside?

What d’ya mean all cake has calories?

The downside is that:

- These annuities are among the most expensive annuities you can buy.

- Their contract restrictions are so severe they substantially limit the annuity stock market interest you can earn. Plus the mixing and matching of these contract restrictions makes it virtually impossible to compare which annuity firm has the best deal.

- The method of calculating your annuity stock market interest is so obscure it’s hard to verify you’re getting the market interest your annuity actually earned.

- There are easier and cheaper methods of managing your money that may well provide you with overall better investment results.

Equity indexed annuities are among the most expensive annuities you can buy.

Prepare to pay a high commission and high recurring fees with equity indexed annuities.

Of all the types of annuities sold, equity index annuities charge the highest sales commissions. The commissions are built into the total cost of the product itself, inflating the price, and invisible to the naked eye. Also, these annuities have relatively high customer fees.

With high fees and commissions, is it any wonder that highly motivated sales agents and annuity firms racked up $72.3 billion in sales for these products in 2019?

Severe contract restrictions limit the market gains you can claim and it’s nearly impossible to compare which company has the best deal.

Dividend exclusions? Participation rates? Spread? Is this English? Just give me the translation.

There are five ways companies restrict the annuity stock market interest you can earn. These are:

- dividend exclusions;

- participation rates;

- interest rate caps;

- administrative fees/spread/margin; and

- a combination of all of the above.

Translation: what in the world are those things?

Dividend exclusions. With dividend exclusions, the annuity company “excludes” all stock market dividends before they calculate the value of the S&P 500 index and the interest you’re due. On average, dividends have accounted for 40% of the S&P stock market gains each decade since the 1930s

Please don’t beg, Mrs. Jones. The fine print on the contract told you we at the company would be lining our pockets with your annuity’s dividend earnings.

This means that if the market goes up by 10%, the annuity firm pockets 4%, and you’re left with 6%.

(40% dividend exclusions x 10% market return = 4% to the annuity firm. What’s left for you is: 10% market return – 4% to the annuity firm = 6% left for you.)

In other words, if your stock market gains were $10,000, you’re only getting $6,000.

Let that sink in. 40% is a big pay cut.

On average, 40% of the stock market is fueled by dividend earnings. Equity indexed annuities typically deny you these earnings!”

Good grief! These equity indexed annuities have a lot of fine print.

Participation rate. Participation rates allow you to “take part” in only a portion of the market’s gains. If the annuity firm imposes a 50% participation rate, you’re only entitled to 50% of the market’s gains. In other words, if the S&P 500 index posts a 10% return, you’re only getting 5%. (10% market return x 50% participation rate = 5%).

If your stock market gains were $10,000, you’re only getting $5,000.

Interest rate caps. Some index annuity companies put a cap on the total interest your annuity can earn, including the interest you’re guaranteed. So if your interest cap is 6% and the S&P 500 index earns its historical average of 10%, tough toenails! You’re only getting 6%. No more. No less.

Interest rate caps. Some index annuity companies put a cap on the total interest your annuity can earn, including the interest you’re guaranteed. So if your interest cap is 6% and the S&P 500 index earns its historical average of 10%, tough toenails! You’re only getting 6%. No more. No less.

Administrative Fees (also called spread or margin). Some equity-index annuities impose an administrative fee that’s deducted from the S&P 500 index returns. For example, if the index earns its historical annual return of 10%, and the administrative fee is 2%, you’re left with 8%. (10% – 2% = 8%).

Combination of the above: Worse, some annuity firms use a combination of the restrictions listed above. By the time they’re done, you could be squeaking by with barely a percent or two above your guaranteed returns, while the market could be up 15%, as it was for 2020.

There are too many combinations of equity indexed annuities. It’s impossible to find the best deal!

The problem is that each company has its own contract restrictions. It mixes and matches them together to add to its own unique bottom line. As such, it’s virtually impossible to compare across companies to find your best deal, as discussed here and here.

In addition, some companies offer minimal restrictions as an introductory offer, but can contractually increase the restrictions at a later date. Such action further limits your ability to find the most competitive annuity to meet your needs.

Add in how your annuity stock market interest is calculated, discussed momentarily, and you may start to feel like your “goose is cooked.”

‘Goose is cooked,’ from the Latin, meaning you’re not going to make the money you thought you were. “

You might as well put a fork in it. But before you do….

A brief digression…

If you don’t make that blogger stop, I will.

Boomer, I sit on a citizen advisory council that routinely meets evenings at City Hall. One evening, we were well-past our adjournment time. Nonetheless, the presenter doggedly continued scrolling through his presentation.

Unexpectedly, one of my fellow citizen advisors (literally) began shouting: MADAM CHAIR! MAD-DAM-CHAIR! MAKE.HIM.STOP! WE’VE HEARD ENOUGH. THE HOUR IS LATE!

Everyone was aghast.

Boomer, I’m aghast right now. I feel like both the hapless presenter and the shouting citizen advisor. I want you to have the details about this product because you will certainly be pitched this annuity at some point in time.

Have you ever considered equity indexed annuities?

The pitch may well occur when you least expect it–like when I was on my way to the airport at 5 a.m. and my moonlighting Uber driver began pitching me.

I’m aware the hour is late for this post, figuratively speaking.

You may want to take a break here and pour yourself an adult beverage. 🍷 I’ll wait right here. I don’t mind…

Yay! You’re back!

Ok, now the real kicker, followed by suggestions for simpler and cheaper alternatives methods to manage your nest-egg.

Their method of calculating your annuity stock market interest is so obscure that it’s hard to verify you’re getting the market interest you’re due.

Take out your #2 pencils! Let’s calculate simple percent change. Then we’ll subtract all the contract restrictions to reduce the interest on your equity indexed annuity.

Boomer, if you or I wanted to see how much interest we’d earned over a specific period of time, called a “term” by the annuity folks, we’d go to a site like Google Finance and look up the S&P 500. Then we’d

- look at the value of the S&P 500 at the beginning of the term;

- compare it to the value of the S&P at the end of the term;

- calculate the percent change; and

- voila– that’s how much interest we earned.

In contrast, annuity firms use their own method of calculating the percent change. They:

- pick two points within a specific time period, called a “term,” and then they

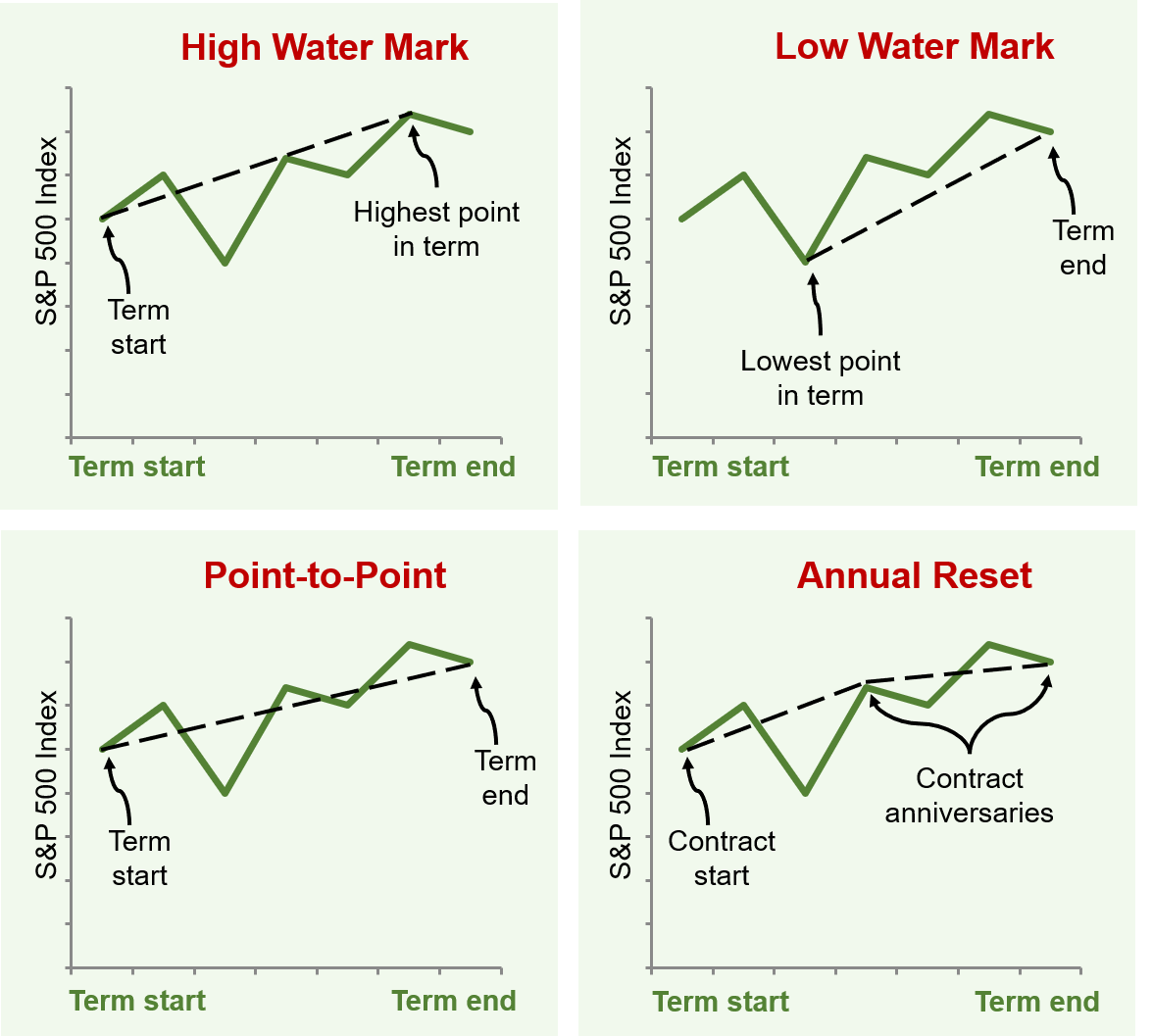

- calculate the percentage change between the two points. The percent change is commonly calculated using one of these four methods:

-

Their methods of calculating my market gains sound like a flood management system. How am I supposed to verify my equity indexed returns?

high water mark;

- low water mark;

- point-to-point; and

- annual reset

-

(Is it me, or do these four methods sound like a statewide flood management system?)

These obscure methods should convey one message.

These companies aren’t in business to lose money.”

For you overachieving verbal learners.❤️ a written description of these four oddly-named methods is shown in Appendix 1. For the rest of you normals 😎 , Figure 1 shows arrows pointing to the two points in time (called the term). The term is the period of time within which the percent change in the S&P 500 is calculated.

Figure 1. Four common methods firms use to calculate your annuity interest. (Arrows indicate the points used to calculate the percent change and interest you earned.)

Sources: National Association of Insurance Commissioners, Buyers Guide to Fixed Deferred Annuities with Appendix for Equity-Indexed Annuities, 1999. Investor alert from the Financial Industry Regulatory Authority (FINRA), Equity-Indexed Annuities: A Complex Choice, 2012;

As you can see, each of these methods compares different points in time to begin calculating the percent change in the S&P 500 and the subsequent interest you’ve earned. Factor in all the contract restrictions and kaboom! Their computer spits out the interest you earned.

Can you verify you’re getting what’s coming to you? Yes? Good for you! You’re smarter than me and the sales agent who sold you the annuity! But there are other alternatives that don’t require you to hand over a chunk of change that might come in handy when one of life’s inevitable emergencies occur.

There are simpler and cheaper nest-egg alternatives to equity indexed annuities.

At last, the simpler alternatives have arrived!

Boomer, each of the alternatives below has been discussed in detail in previous posts, so we won’t belabor them here. But using the three methods, separately or in combination, may well do a better job of feathering your nest than does an equity indexed annuity.

Consider using the 4% Rule. Research suggests that following the requirements of the 4% Rule should enable you to hang onto your money until you exit stage left. You can go even more conservative than 4% by using 2% or 3% to help ensure your money lasts even longer. Check out the post!

Consider an immediate annuity. These annuities are the cheapest and simplest annuities you can buy, and at press, provide you more income than application of the 4% Rule would. At some point, interest rates will go back up, so consider laddering your annuities to get even more cash. Just make sure you protect yourself by following the precautions listed here, here, and here.

Always keep a cushion of cash on hand.

(Always) keep a cushion of cash on hand. The big pitch for equity indexed annuities is they keep you from losing money. Bulletin! Here’s another way to keep from losing money. Keep some cash on hand so you’re not withdrawing money during a prolonged down market recession. An 11 to 36 month emergency fund should adequately provide you the safety net you seek–as discussed here.

Alone or in combination, all three of these alternatives save you the annuity fees and commissions, enable better access and control of your money, and are more understandable than the inherent complexity of an equity indexed annuity.

Steps to take if you want to buy an equity indexed annuity.

Boomer, if you love a challenge and want to spend your money and intellectual horse power finding that perfect equity indexed annuity, then protect yourself by taking the action steps listed in Appendix 2. Then, schedule a meeting with your sales agent and ask the questions shown in Appendix 3, recommended by the National Association of Insurance Commissioners (and yours truly). Then, if you’re still breathing, plow through the (short) readings I’ve posted at the bottom.

For everybody else..

Exit Fantasy Island.

I gotta get off this island!

As for my friend who was so gleeful when he bought his equity indexed annuity, I told him what I’ve told you. I also suggested he take the contract to an attorney and have it looked over just to be sure he was getting what he expected. His free look period gave him 10 days to change his mind.

Although he started getting cold feet by the length and complexity of the contract, he didn’t seek out legal advice. But he’s smart enough to want to keep things relatively simple when it comes to his money–just like Warren Buffet and Peter Lynch advise.

So on day 10, he exercised his free look option and got a full refund.

He said good-bye to the dream of cake without the calories.

$$$

Appendices

Appendix 1. Description of the four most common methods annuity firms use to calculate interest on an equity-indexed annuity.

High water mark compares the highest value the S&P index attained during the life of the term. It compares that value against the value of the S&P 500 at the start of the term. The two numbers are run through the firm’s financial formula, restrictions noted in the earlier section are applied, and voila! The computer spits out your interest–if there is any.

Low water mark is the mirror image of the high water mark. The low water mark use the lowest value that the S&P 500 falls to during the life of the term. It then compares that value against the value of the S&P at the of end of the term. Once again, those two numbers are run through a financial formula, the firm’s restrictions on your market gains are applied, and kaboom! You’re maybe paid interest.

Point-to-point simply compares the value of the S&P index at the start and end of the term. It then uses the same procedures as the previous two methods to determine how much interest you earned.

Annual reset compares the S&P at the start and end of each year of your contract, for however long the life of your contract is. Interest is locked in each year using the methods described above. As you can see, from the Figure 1, some years your interest will be higher than others.

Appendix 2. Action steps to take before buying an equity indexed annuity.

- Take advantage of the free-look period and carefully review your contract as soon as you get it. Make the sales agent explain anything you don’t understand.

- Make sure you understand what your surrender charges will be should you want out after your free look period has passed. (Some equity indexed annuities to have surrender charges of 20% and last as long as 15 or more years.)

- If you’re not deterred by your surrender charges, or want a way around them, read this post on getting out of a bad annuity.

- Make sure you’re not buying an annuity headed for bankruptcy and take all the precautions listed here.

- Read the Investor Alerts published by the SEC and FINRA — listed in the Recommended Reading section below.

- (If you’re still breathing at this point) do your own added due diligence (always).

Appendix 3. Questions to ask your sales agent before buying an equity-indexed annuities.

- How long is the term of my contract?

- What is the guaranteed interest I earn?

- Does my contract have an interest rate floor or buffer? Which?

- How much is it?

- Does the contract have an interest rate cap?

- What is it?

- Are dividends excluded from the interest I earn?

- What is the participation rate?

- How long is the participation rate good for?

- Is there a minimum participation rate?

- Is there an administrative fee?

- What is it?

- What other recurring fees do I pay?

- Do I earn compound interest on this annuity?

- What method is used to calculate changes in the S&P 500, e.g., high water mark, low water mark, point-to-point, annual reset, or something else?

- What are the surrender charges or penalties if I want to end my contract early and take out all of my money?

- Can I do a 1035 swap on this annuity?

- Can I get a partial withdrawal without paying surrender charges or losing interest?

- What is the annuity firm’s financial strength rating and may I get a copy?

Extra! Extra! Read all about it!

Investor Bulletin: Indexed Annuities, Securities and Exchange Commission, August 13, 2019.

The complicated risks and rewards of indexed annuities, Financial Industry Regulatory Authority (FINRA), May 11, 2016.

Equity-Indexed Annuities: A Complex Choice, Financial Industry Regulatory Authority (FINRA): September 13, 2010.

Indexed annuities: look before you leap, Fidelity Viewpoints, October 11, 2019.

$$$

Annuity Series (Oldest to Newest)

- Annuities: Eleven Critical Questions to Ask Before You Buy (Or Even After You Own)

- Lose Your Bad Annuity Without Losing Your Shirt. (Maybe)

- Annuity Bankruptcy: Don’t Fund Your Retirement with an Annuity Headed for Bankruptcy (Like I Did)! Three Must-Do Actions.

- Immediate and Longevity Annuities: The Cheapest Way to Buy Income for Life — Everything You Ever Wanted to Know

- Equity Indexed Annuities: Beware the Seduction!

- Fixed Annuities: Higher Rates Than CDs. Worth it?